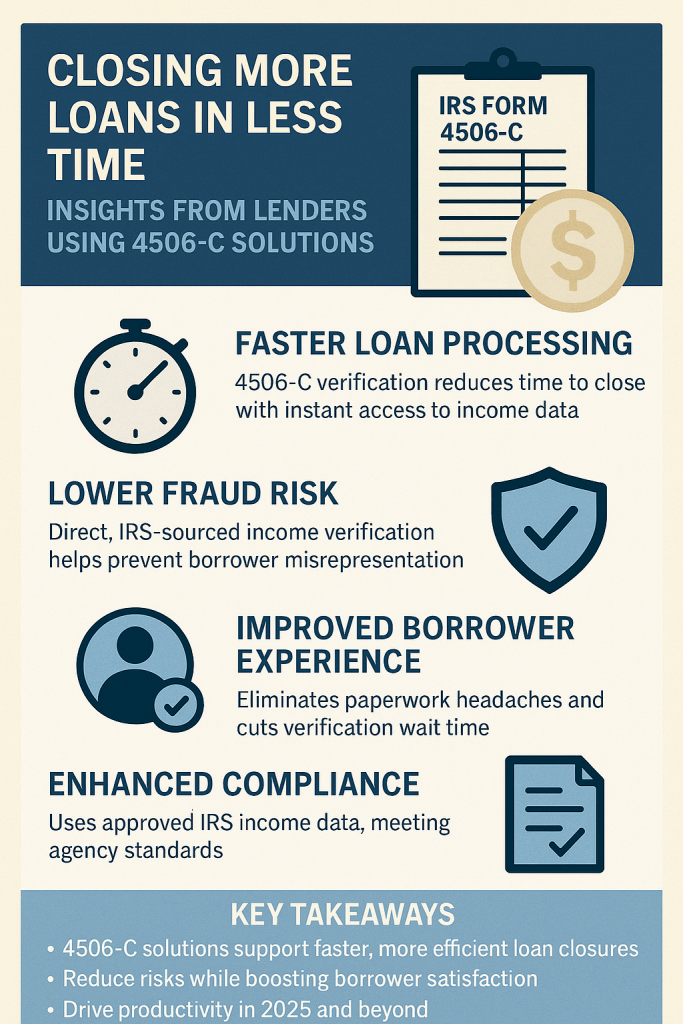

Closing More Loans in Less Time: Insights from Lenders Using 4506-C Solutions

In the modern lending landscape, speed and accuracy are not just competitive advantages. They are expectations. Borrowers want fast, seamless experiences, while lenders must verify income with precision and ensure compliance with tightening regulatory oversight. In an environment where fraud is on the rise and borrowers have more lending options than ever, having a robust, secure income verification solution can make or break your pipeline.

One solution making a measurable impact is the IRS 4506-C form: a secure, standardized way to retrieve tax transcripts directly from the IRS. When integrated correctly, it reduces processing times, minimizes fraud risk, and delivers verified income data that helps lenders make better credit decisions faster.

What is the 4506-C Form?

The 4506-C form authorizes a third party (such as a lender or verification provider) to obtain tax return transcripts from the IRS. This provides a complete, unaltered view of a borrower’s reported income over multiple years. Unlike traditional document-based verification methods, IRS transcripts are sourced directly from the IRS, making them more reliable and less prone to manipulation.

This is especially valuable for lending to:

-

- Self-employed borrowers

- Gig economy workers

- Seasonal employees

- Borrowers with complex or fluctuating income profiles

2025 Trends Driving 4506-C Adoption

Several factors are accelerating the industry-wide adoption of 4506-C-based income verification in 2025:

-

- Increased fraud incidents: Mortgage and personal loan fraud has been increasing in 2025.

- Stricter investor and GSE requirements: Fannie Mae and Freddie Mac are emphasizing transcript-backed VOI to support loan buybacks and quality control.

- Demand for digital, borrower-friendly processes: Borrowers prefer not to upload W-2s or tax returns manually. Automated transcript pulls simplify the process.

- Rising cost of loan origination: Lenders are seeking ways to streamline operations and reduce manual labor without sacrificing compliance.

Speed, Accuracy, and Security: Key Benefits

1. Faster Loan Processing

Lenders using automated 4506-C transcript solutions report reductions of 2 to 5 days in loan cycle time. By initiating transcript requests early in the process and integrating with their loan origination systems, they avoid back-and-forth delays with borrowers.

2. Improved Data Accuracy

IRS transcripts eliminate errors found in self-reported income documents or edited PDFs. This improves underwriter confidence and can reduce conditions, helping loans close faster.

3. Built-In Fraud Prevention

Because the data comes straight from the IRS, it’s far harder to forge than traditional documents like pay stubs or bank statements. This helps reduce repurchase risk and improves audit outcomes.

Best Practices from Leading Lenders

Lenders maximizing their return on 4506-C solutions share these operational strategies:

-

- Automate: Use APIs to integrate transcript requests directly into the LOS for faster delivery.

- Order early: Initiate transcript pulls at application or pre-approval to gain early income insight.

- Layer verification: Combine IRS transcripts with SSA-89 identity checks and bank data for a holistic risk profile.

- Educate teams: Ensure loan officers understand how to explain transcript-based verification to borrowers and address privacy questions confidently.

Looking Ahead

As we move into 2026, industry leaders are calling for broader standardization of IRS transcript verification. With new fraud typologies, compliance updates, and a push toward automation, lenders who adopt 4506-C solutions early are seeing faster approvals, stronger loan quality, and more confident lending decisions.

Key Takeaways

-

- Speed: IRS 4506-C processing can reduce loan origination time by several days.

- Accuracy: Official IRS data eliminates inconsistencies in borrower-submitted income documents.

- Fraud Prevention: Secure, direct-from-source data drastically reduces forgery risk.

- Efficiency: Automation reduces manual tasks and accelerates underwriting.

- Compliance: IRS transcripts support adherence to investor, regulator, and GSE guidelines.

Ready to transform your lending experience? Contact us to get started and ensure efficiency and reliability in your loan approval processes.

Have questions? Speak to a Private Eyes expert for more information.