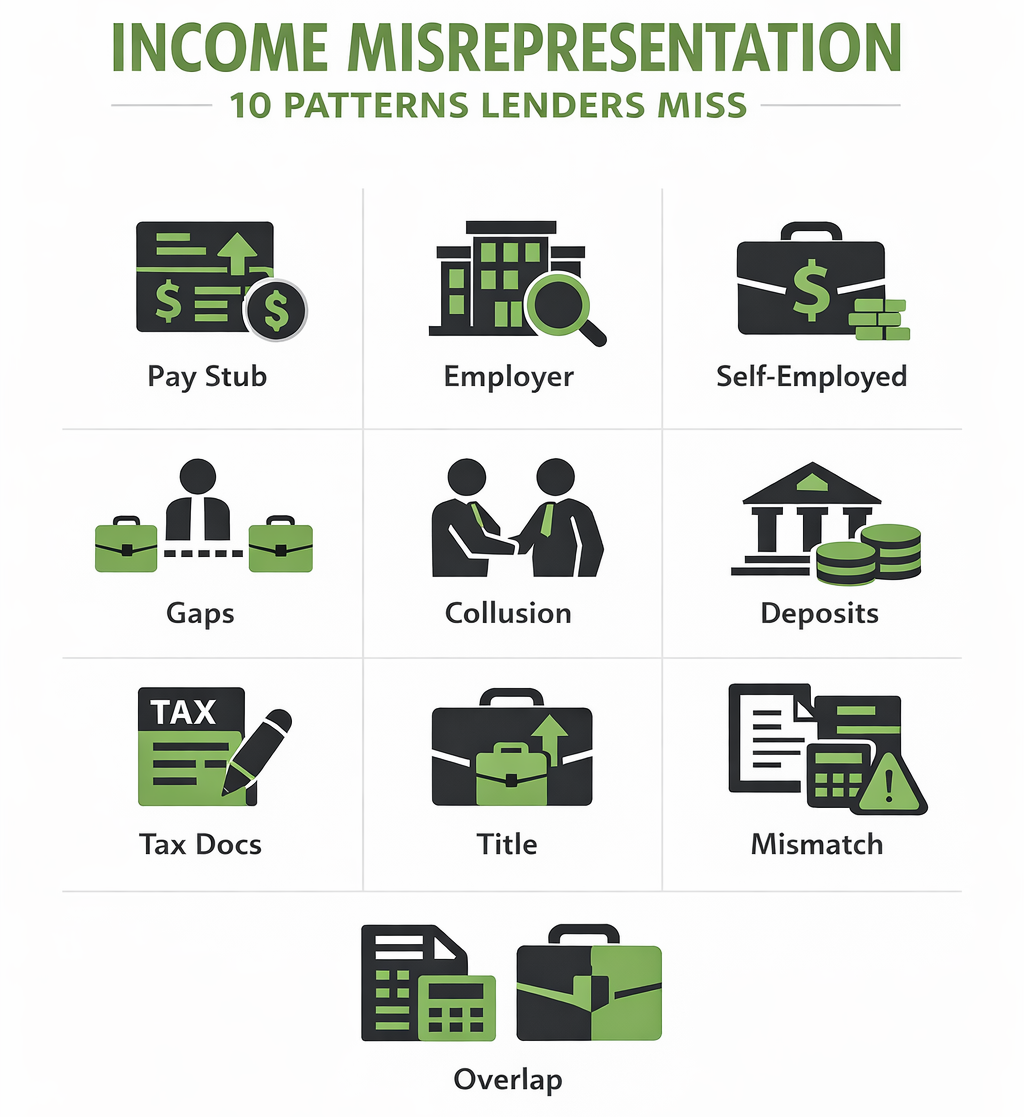

Income Misrepresentation: The Top 10 Patterns Lenders Miss

In a competitive lending environment, speed matters. Accuracy matters more. Income misrepresentation remains one of the most common and expensive forms of applicant fraud across consumer, mortgage, and small business lending. What makes it tricky is that many files look clean at first glance. The problem is not a lack of documents. The problem is missed patterns.

In lending operations, Quality Assurance (QA) is the set of checks a second set of eyes, a control team, or an automated review process uses to confirm that a file is accurate, consistent, and compliant before it is approved or funded. It’s guardrail that catches errors and fraud indicators that can slip past a fast-moving front-line review.

Below are ten income misrepresentation patterns lenders often overlook, paired with practical QA flags and process improvements you can implement right away.

Pay stub inflation

Applicants may present pay stubs with exaggerated hours, overtime, commissions, or bonuses that do not align with the position or the industry.

QA flags (Quality Assurance checks)

Look for unusually high earnings for an entry-level role. Watch for perfectly round numbers, inconsistent year-to-date totals, and pay periods that do not line up with calendar dates.

Process improvements

Standardize a pay stub review checklist that includes pay frequency validation, year-to-date math checks, and a comparison to typical wage ranges for the role and geography. When risk is elevated, validate income through independent sources rather than relying solely on borrower-provided documents.

Fake employers or front businesses

Some applicants list employers that do not exist or use a real business name while routing verification calls and emails to a friend, family member, or the applicant.

QA flags

Employer email domains that do not match the company name. “HR” contacts who only answer from a personal mobile number. A company with no credible online footprint, no physical address, or a recently created website.

Process improvements

Add an employer legitimacy step to your workflow. Verify business registration, web presence, and directory listings. Use third-party verification when possible. For higher-risk files, confirm income using IRS transcript options when applicable to your product and program requirements.

Self-employment fabrication

Applicants may claim self-employment income without credible evidence of business activity or may inflate revenue while downplaying expenses.

QA flags

Vague business descriptions, no business registration, no online presence, inconsistent EIN usage, or missing tax schedules that typically support self-employment income.

Process improvements

Require a consistent document set, such as recent tax returns with applicable schedules, business registration documentation, and bank statements that show business cash flow. Train reviewers to evaluate plausibility of revenue patterns by industry type.

Employment gaps filled with invented work history

Short-term roles are inserted to cover gaps and create the appearance of stable employment.

QA flags

A job listed for a brief window with no corroboration in public profiles, no verifiable supervisor, or inconsistent dates across the application, resume, and documentation.

Process improvements

Use structured timeline checks that compare the application, credit report employment fields, and verification responses. When something does not reconcile cleanly, move the file to secondary review instead of allowing close enough answers.

Employer collusion or friendly favors

A legitimate employer may misstate income, hours, or job status as a favor to the applicant.

QA flags

Verbal verification conflicts with written documentation. Job duties described do not match the title. Income stated in the verification call differs from pay stubs or W-2s.

Process improvements

Build a policy for when a single-source employer verification is not sufficient. Consider requiring a second corroborating source, such as W-2, tax transcripts where permitted, or consistent bank deposit evidence tied to payroll.

Bank statements with curated deposits

Applicants may inflate deposits using temporary transfers, cash deposits, or circular movement of funds to mimic payroll.

QA flags

Recurring deposits with identical amounts that do not match a payroll cadence. Sudden large deposits near application dates. Multiple transfers between accounts that appear engineered to create a balance.

Process improvements

Review transaction descriptions and deposit sources, not just totals. Require additional months of statements when patterns look engineered. Implement a source of funds escalation when large deposits are unexplained.

Altered tax documents

Digitally edited W-2s and 1040s can be polished and convincing, especially when PDFs are provided.

QA flags

Formatting and font inconsistencies, odd spacing, misaligned boxes, or numbers that do not mathematically reconcile across line items.

Process improvements

Do not treat borrower-provided tax documents as a primary source on higher-risk files. Use IRS transcript verification workflows when applicable. Create a rule that any visible formatting anomalies trigger independent validation.

Job title inflation to justify income

An applicant lists an elevated title to support a higher claimed income or to make the file appear more stable.

QA flags

Executive titles at very small businesses without corroboration. Duties described that do not fit the title. Income inconsistent with typical compensation bands for that role.

Process improvements

Verify role and title during employment verification, not just dates and pay. Use compensation range data as a reasonableness check and require documentation that supports the level of responsibility claimed.

Inconsistent income across documents

Income figures may shift between the loan application, pay stubs, W-2s, and tax forms.

QA flags

Small mismatches that are repeated across the file. Annualized income calculated from pay stubs that does not match stated base pay. Conflicting bonus or commission numbers.

Process improvements

Use a standardized reconciliation worksheet or calculator that forces reviewers to document how income was derived and which document was treated as the authoritative source. Add a QA rule that requires resolution of discrepancies before clear-to-close.

Overlapping employment dates that inflate total income

Applicants may claim two full-time jobs at the same time or overlap dates to increase total qualifying income.

QA flags

Overlapping full-time roles without a credible explanation. Work hours that exceed realistic totals. Employment timelines that conflict across documents or verifications.

Process improvements

Run a timeline consistency review that checks start and end dates, pay period overlaps, and plausibility of hours. When overlaps exist, require additional proof that both jobs are real and that the borrower can sustain the workload and income.

Practical QA upgrades that reduce income misrepresentation

Implement a two-tier review model. Tier one handles standard files with a structured checklist. Tier two is a targeted fraud review for files with triggers such as new jobs, inconsistent numbers, unverifiable employers, or engineered deposits.

Train teams to focus on patterns, not paperwork volume. Fraudsters often submit more documents, not fewer.

Add documentation integrity checks. Require original PDFs from issuing systems where possible, and flag image-based statements, screenshots, or files with signs of editing.

Use independent verification strategically. Where your program allows, incorporate third-party employment verification, IRS transcript validation, and identity verification tools to reduce dependence on borrower-provided documents.

Private Eyes income verification services help lenders reduce this risk without slowing down the file. We combine document-level QA (pay stubs, W-2s, bank statements, and tax forms) with independent verification options so income can be confirmed from reliable sources, not just borrower-provided paperwork. When a file has elevated risk signals like mismatched figures, unverifiable employers, or unusual deposit patterns, our team supports a fast escalation path that helps underwriting resolve discrepancies early, document the decision defensibly, and move qualified borrowers to the closing table with greater confidence.

Key Takeaways

- Most income misrepresentation is detected through patterns across documents, not a single obvious red flag.

- Pay stubs, bank statements, and tax forms should always reconcile with each other and with the story of the loan.

- Employer legitimacy checks help stop fake employers and “friendly” verifications.

- Formatting, math errors, and inconsistent dates are common indicators of altered documents.

- Use clear escalation triggers so suspicious files move to enhanced review fast.

- Independent verification tools reduce reliance on borrower-provided paperwork.

- Consistent checklists and reconciliation worksheets make fraud harder to slip through.

Ready to transform your lending experience? Contact us to get started and ensure efficiency and reliability in your loan approval processes.

Have questions? Speak to a Private Eyes expert for more information.