Current Trend in Foreclosure Rates

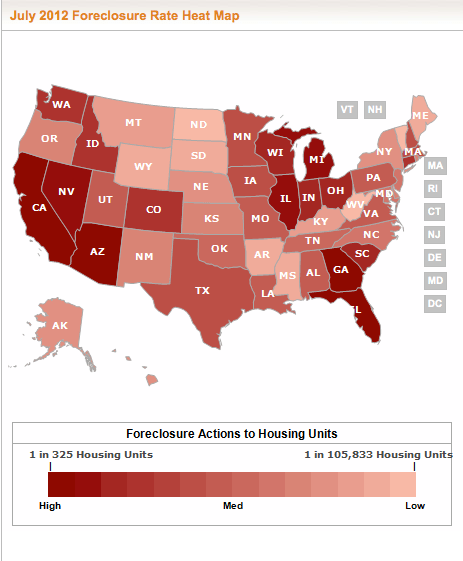

According to a report by RealtyTrac® Inc., 1 in 666 housing units received a foreclosure filing in June 2012. This increase in foreclosure was seen in almost 60% of larger cities in the U.S., and is an indication that there will be many homes on the market by the end of the year. According to a report by RealtyTrac® “foreclosure activity in the first half of 2012 increased from the previous six months in 125 of the nation’s 212 metropolitan areas with a population of 200,000 or more.”

California topped the list by accounting for seven out of the ten highest metro foreclosure rates and ten out of the top twenty metro foreclosure rates during the first half of 2012. Florida came in next with four out of the top 20 metro foreclosure rates, and Illinois accounted for two.

So what is happening in the sunshine State?

Out of the seven metro areas among the first 10, Stockton, Modesto, and Riverside held the top three spots, even though they posted lower totals than 2011. The governor of California has signed Homeowner Bill of Rights to keep in check the downward trend. This bill is supposed to protect homeowners and borrowers during the mortgage and foreclosure process. More on this topic in our upcoming posting.

The whole system is askew, making it harder to bring the numbers down. You would naturally ask, “Why is the system so difficult?” Well, according to data we collected it takes an average of 370 days for a bank to resolve a standard foreclosure deal. To that, you can add approximately 180 days for the actual sale to take place (compared to the 150 days it took to close a deal in 2007). To top it off, houses that come through Fannie Mae follow strict rules like:

1) No price reduction for the first 30 days.

2) Price reduction of 5%-10% after the first month.

Some of these properties have been neglected for almost a year and a half with ill maintained yards, bringing prices of neighbouring properties down. However, it is not all that bleak. The silver lining is showing in the trends of increasing pre-foreclosure sales. They help in minimising the losses and in some cases the pre-foreclosure sales bring higher sale price than a foreclosure sale. It might take some time for the housing market to be back on its feet but we see the ray of light not afar.