Check & Report Tax Scams: How You Can Do It

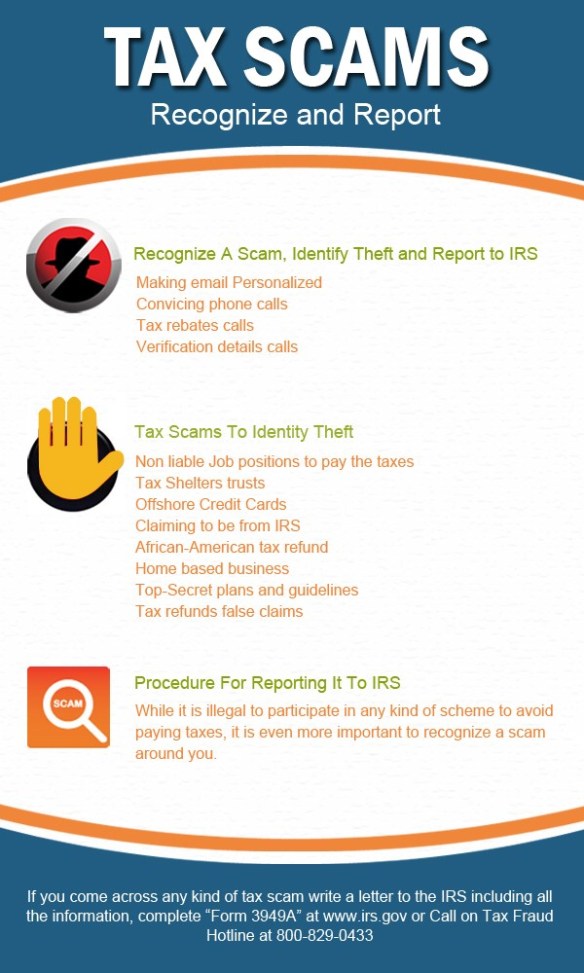

The Internet is growing like a forest fire since its inception and this has opened doors for criminal activities, frauds, scams, etc. The tax frauds and scams are no exception for cyber fraudsters. While it is suggested that you must report a scam directly to the IRS, most people lack awareness to ‘recognize’ and ‘report’ the scam in the first place.

These scams are aimed at stealing private & confidential information through various unscrupulous means like unsolicited calls asking for details, emails with spam links, etc.

How To Recognize A Scam?

A scam is always too good to be true. There are various tricks used by hackers to perform identity theft with the use of Internet.

Some of the most common tricks are:

- Making the salutation and subject of the email personalized

- Highly convincing phone calls, probably live

- Calls providing you information about your tax rebates (Out of the blue!)

- Emails claiming to provide services for tax refund & audit

- Phone calls for verification of details

IRS guidelines make it clear that you don’t need to provide your confidential details through phone on an email. They have the procedure of sending information through snail mail, but you need to ask them. In addition to US postal service, you can also check your details by visiting their website.

The most famously used tax scams to identity theft:

- Some job positions are not liable to pay the taxes (and they have the list)

- Trusts posing as Tax Shelters (they are illegal)

- Offshore Credit Cards (for the sole purpose of avoiding taxes)

- Claiming to be from IRS

- A tax refund for you because you are an African-American

- Home based business to save taxes

- Top-Secret plans and guidelines for saving taxes (just for you!)

- False claims for tax refunds

What Is The Procedure For Reporting It To IRS?

While it is illegal to participate in any kind of scheme to avoid paying taxes, it is even more important to recognize a scam around you. Such kind of activities can save you from fines, penalties and imprisonment.

If you come across any kind of tax scam:

1) You can always write a letter to the IRS including all the information that you have.

Mail Address:

Internal Revenue Service Lead Development Center

Stop MS5040

24000 Avila Road

Laguna Niguel, California 92677-3405

Fax: (877) 477-9135

2) You can complete “Form 3949A” at www.irs.gov.

3) Call on Tax Fraud Hotline at 800-829-0433