Electronic Signatures on IRS form 4506-T: Now a Reality!

The growing number of mortgages and loan modifications has increased the urgency for a faster approval process by taking it entirely online. A tax return transcript is the dire need of every mortgage origination and loan modification. The 4506-T forms are the only documents in the loan origination process that require handwritten signature and are used by lenders for the verification of borrower’s income. This has increased need for e-signatures on 4506-T forms.

The IRS has already started accepting e-signatures on 4506-T forms with its main goal to offer a paperless application process.

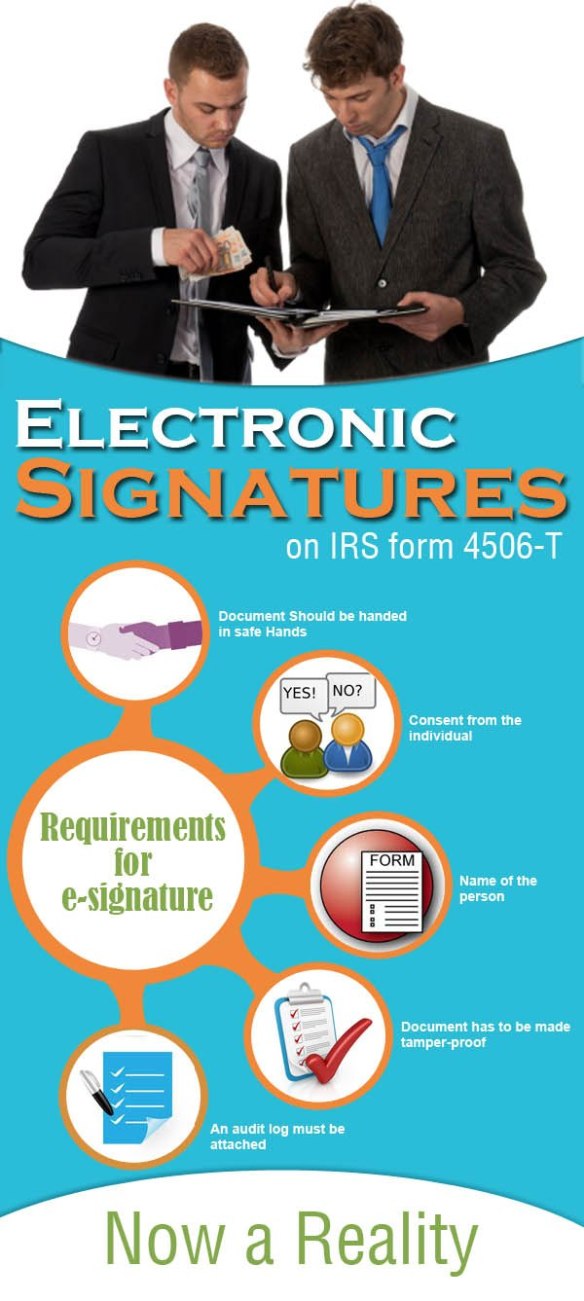

The requirements for e-signature are:

- The document must be handed into safe hands after validating the authenticity of individual signing it

- A consent from the individual is required to confirm the receiving and signing of documents electronically

- The consent form must include name of the individual signing the document

- After the above said process, the document has to be made tamper-proof

- While submitting the order, an audit log must be attached with the IRS consent form.

The participants of the Income Verification Express Services (IVES) are required to follow the suggested framework, but it is their own decision to provide e-sign as an option to the borrowers. The basic flow will still remain the same, but it should speed-up the process by taking it entirely online.

Note: The audit log must be attached as single image file along with the IRS consent form in PDF or TIFF format.

According to the Paperwork Reduction Act, 1995, it has become mandate for the Treasury to put in efforts for reducing the paperwork and quicken the process. Earlier, most of the lenders used to avoid automation of transaction process because of the requirement of a “wet signature” on the documents. The e-signature will allow them to completely automate the process online.

In addition to above, it will suffice the need of a cost-effective method that can handle the large volume and reduce the probability of loss or errors in the documents.