How Can Digital Identity Verification Help Prevent Fraud?

One of the most important things that lending businesses need to focus on is preventing fraud as this activity results in a significant loss of income.

Fortunately, digital identify verification not only helps prevent it but does so in a timely manner, essential for keeping prospective customers interested and current ones content.

Impacts of Fraud on Lending Institutions

In 2022, financial firms based in the U.S. reported that it ultimately cost them $4.23 for every $1 that was lost due to fraud. Meanwhile, in the first quarter of 2023, there were 496,000 frauds and 280,000 identity thefts reported to the Federal Trade Commission.

Presentation Attacks and Synthetic Identity Thefts

This trend increased with the advent of the internet age and has accelerated in recent times now that deep fakes and other changes to photos and documents can appear more realistic than ever.

In many cases, bad actors will engage in presentation attacks, which can consist of altering photographs of people and even their fingerprints in order to garner a loan in their name.

Another strategy is to engage in synthetic identity thefts, which involves the combination of real and false details that are related to someone’s name, address, date of birth, social security number or other identifiable pieces of information.

Solution: Digital Identity Verification

It is essential to limit how much time it takes to verify someone’s identity as an extensive delay can result in people who are in fact representing themselves getting frustrated and deciding not to continue.

Digital identity verification can complete this process much more quickly. In many cases, the amount of time that is devoted to this can be reduced from as long as weeks all the way down to seconds.

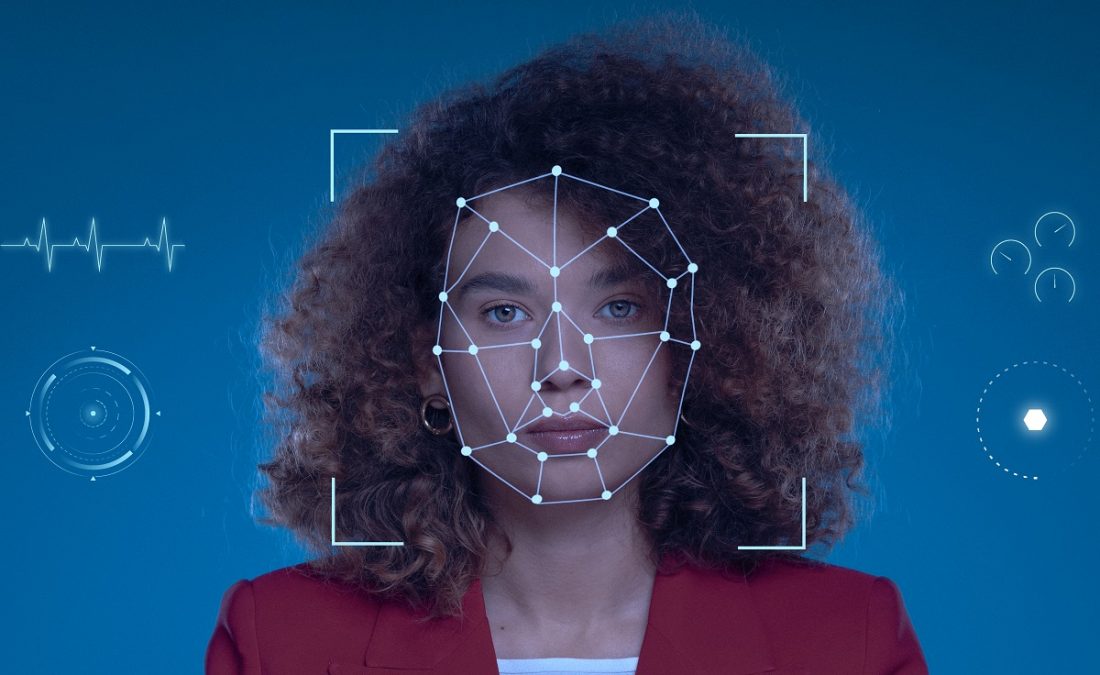

It does this by automatically verifying data sources and identity documents, including photos and fingerprints. This process can also involve analyzing the applicant’s device, phone number, email address and selfie verification.

The primary financial benefits of taking advantage of digital identity verification are related to reducing instances of fraud and decreasing how much time employees need to devote to this process.

Contact us to find out how we can help you close loans faster with employment verifications and 4506C income verifications.

Have questions? Speak to a Private Eyes expert for more information.