What Industries Require A 4506-T?

What is a Form 4506-T?

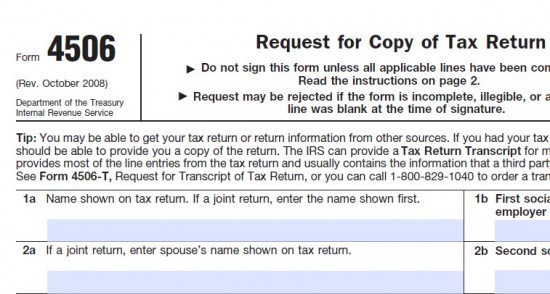

By definition, a Form 4506-T is an IRS document used to retrieve past tax returns, W-2, and 1099 transcripts on file with the IRS. This document grants permission to third parties to retrieve a taxpayer’s information. It must also be signed and dated by the taxpayer. A 4506-T transcript offers institutions quick accurate records such as: income verification, background checks, and public records searches.

What Industries Need a 4506-T?

With fraud practices being on the rise in the United States, more business and organizations are in need of reliable information before lending money to businesses or individuals. The businesses that are more prone to this illegal activity are banks, mortgage lenders, and credit unions.

Mortgage Lenders Mortgage lenders lose money when they’re lending practices are not diligent in acquiring information about debtors. They would need this type of data to ensure that debtors can make payments in a timely manner. This is especially important when they dealing with a substantial loan.

The same goes for credit unions, being that this type of financial institution is approached for loans more than any other type of lending or funding source. Tax fraud is an ongoing practice that is a thorn in the lender’s side. More individuals are trying to get over on the system by not reporting earnings on the W2s. Even worse, some just choose not to file their taxes at all.

Banks are wide open for income fraud practices and one of the most popular spots. Banks have to be extra careful when lending money to individuals. Shady operators run for the hills once they obtain their money. A 4506-T transcript provides banks with the valid information they need about their debtor.