Are You Stuck in a Housing Short Sale Cycle?

We came across a very interesting study from the California Association of Realtors® (C.A.R.) on the cycle of housing short sale and will be evaluating the same in this blog. 2012 has lenders rejoicing a little because they have had some luck in handling short sales, even though the process is still in need of improvements. “A short sale is one where the lender agrees to release its lien in return for a payoff less than the actual balance of the mortgage.”

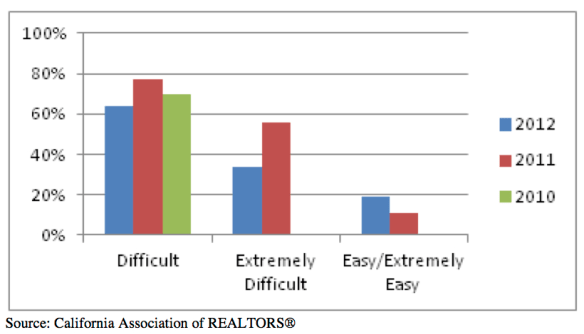

The third annual survey on short sales conducted by the industry group found that 64 percent of its members have had difficulty closing these sales with 34 percent describing the difficulty as extreme (compared to 56 percent in 2011) while the percent of people who felt their recent transaction to be easy or extremely easy rose to 19, compared to 11 percent in 2011.

Problems pertain in the areas of lender response time to a short sale deal and communication with the lender, each increasing y-o-y to 67% and 55% respectively in 2012. Improvements were seen, though, in solving problems with appraisals and dual track issues where a lender forecloses in the midst of the short sale negotiations.

“While it’s encouraging that lenders are making headway in improving their short sale processes, they still have more work to do to ensure that not only Realtors, but also home sellers and buyers have a better experience when dealing with short sales,” said LeFrancis Arnold, C.A.R. President.

More people showed overall satisfaction in working with lenders during short sales, with 59 percent expressing dissatisfaction, (an improvement from 75 percent in 2011). Also, slightly more realtors are ready to refer buyers to a lender for future home purchases.

The association has also included a new “Lender Performance Index (LPI)”, which measures realtor-lender satisfaction. The graph has risen steadily over the past three years but is still well under the middle range of 50. According to the trade group, any number above 74 is extremely good and below 24 is poor. This shows that more efforts need to be taken by the lenders to smooth their communication process. Anyhow, since some improvements are visible, there is definitely a glimmer of hope.