How to Get 4506 Transcripts Right: A Loan Officer’s Success Guide

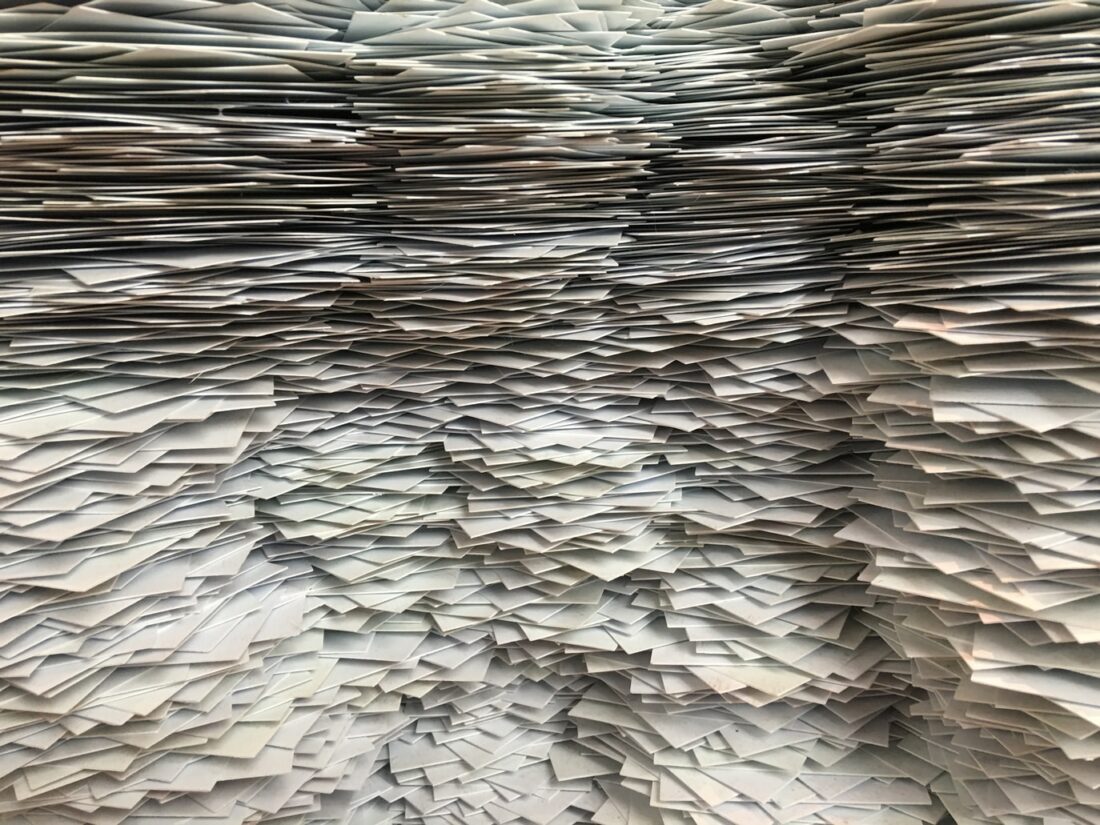

Loan officers face a critical challenge - securing 4506 transcripts efficiently to complete loan applications. These essential IRS documents directly impact loan approvals, with delays causing missed closing deadlines and disappointed clients. Our proven expertise with 4506 transcript processing delivers results that matter to your business.