Foreclosure Vs. Short Sale

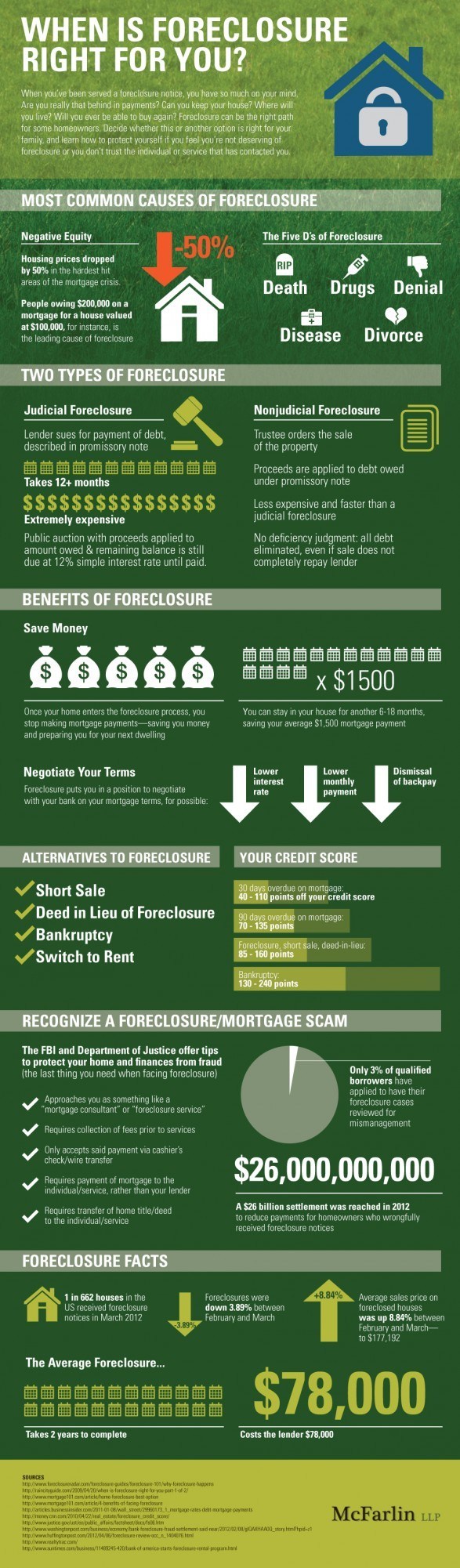

Before you make a decision regarding short sale or foreclosure of your house, make sure that you are taking the right route and if foreclosure is the right option for you situation. “A short sale is one where the lender agrees to release its lien in return for a payoff less than the actual balance of the mortgage.” A foreclosure on the other hand “is a specific legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan.” Which is better, you may ask. Both have their own pros and cons. Let’s take a closer look at foreclosures.

There are two types of foreclosure that you need to know about: Judicial foreclosure, where the bank/lender sues the homeowner for payment of debt. This is a more long-drawn and expensive process. The other option is the non-judicial foreclosure, where the trustee orders the sale of the property. This is less expensive and faster. Foreclosure also has some benefits, when compared to short sales. For instance you can stop paying mortgage and start saving that money as soon as the foreclosure process begins, you can continue living in your home for another 6-18 months. You also have the right to negotiate with the bank for lower interest rate, lower monthly payment and dismissal of any back pay.

As with any financial dealing, make sure that you do not fall into any scam, and ensure that you make the most out of the foreclosure of your home. The Infographics below covers up the scenario well.