Reverse Mortgage: Everything You Need to Know

PART I

How would you react to a deal where you get to en-cash your home equity without having to move out of the property, sell the property or repay anything at all? It may be hard to believe that such a debt instrument exists. But it truly does!

A Reverse Mortgage is a loan given out to homeowners who are 62 years or older. Simply put, it is tapping a portion of your home equity and converting it into cash. The loan is usually used to initiate home improvement, pay off existing mortgage, supplement retirement income or meet immediate expenses. And here’s the real treat. You can stay in your home as long as you want without having to pay any interests on the loan. The repayment starts only when the homeowner passes away, sells the house or moves out. A win-win game, perhaps! That is why it is helpful to old aged and pensioners whose retirement savings doesn’t substantiate enough for a living or who have thin chances of getting a decent job. In the words of many old aged borrowers, reverse mortgage is nothing short of a Financial Salvation.

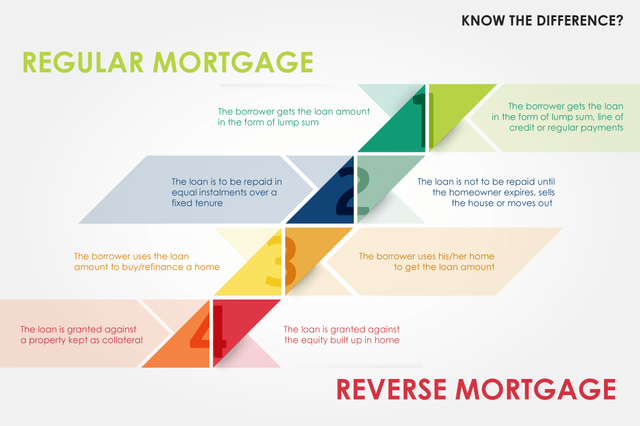

It would be easier to understand it if we see it in contrast to Regular Mortgage. It is actually a regular mortgage turned upside-down.

But is it not the Same as Home Equity Loan?

Reverse Mortgage and Home Equity Loan serve the same purpose that is getting you a loan based on your home equity. But both work quite differently. Firstly, the borrower needs to make repayment (principal + interest) on the home equity loan but not on reverse mortgage. Secondly, a home equity loan is given on the basis of your income and credit score while a reverse mortgage does not take into account either of the two.

What are its Types?

There are three types of reverse mortgages:

1. Single-Purpose Reverse Mortgages – Low cost loans offered by non-profit organizations and government agencies. As the name suggests, the loan amount can only be used for a single purpose such as paying off a debt or home improvement.

2. Home Equity Conversion Mortgages (HECM) – As of now, HECM is the most popular reverse mortgage in the US. It is insured by the Federal Housing Administration and is the only mortgage program backed by the U.S. Federal Government.

3. Proprietary Reverse Mortgages – High interest rate loans offered by private lenders. Subject to government regulations but are not federally insured.

Who’s Eligible?

In US, if you are applying for a reverse mortgage, you must meet the following criteria:

• You must be at least 62 years of age

• The property must be your principle residence

• Your must have paid-off a significant part on your current mortgage (before you get it covered with reverse mortgage)

• And here’s the good news, you can qualify for a reverse mortgage even if you are low on income or credit score

How Much Loan Amount Can I Get?

The lending amount varies from borrower to borrower. The deciding factors remain primarily the same:

• Age of the youngest borrower

• The value of the home

• Current interest rate

Here’s the rule of the thumb – The older you are and the higher your home’s value, the higher is the loan amount you can get.